Kairos™

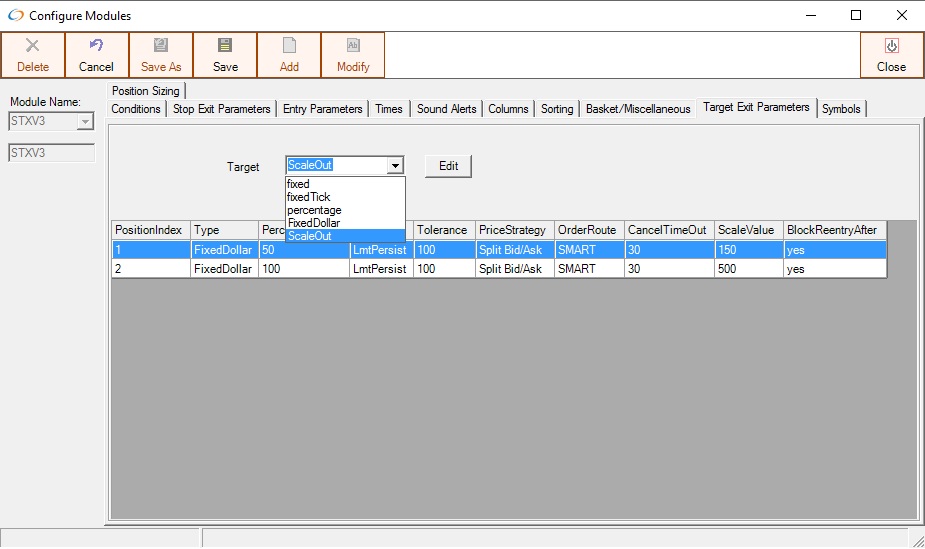

Target Exit Parameters - ScaleOut

Kairos Automated Trading Platform(KATP) has a powerful mechanism for scaling out of positions, called OrderScaling, and selected with the ScaleOut Target Exit selection. As an example, you can sell ½ your position at one target and the remaining position at a second target. It is not limited to only 2 targets – you can configure as many targets as you like.

Selecting ScaleOut will show the targets associated with the module. Each row is a different target.

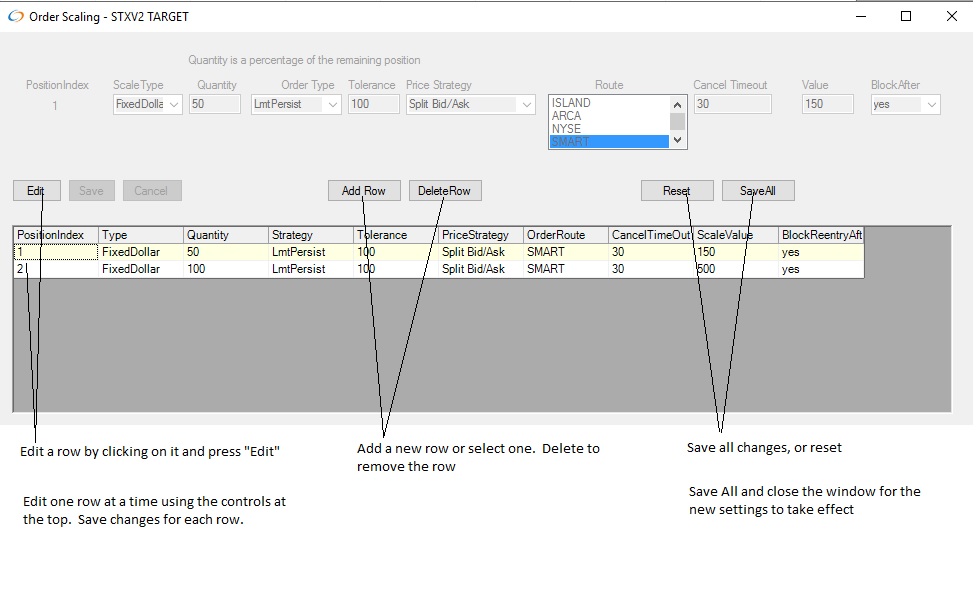

To Add a row/Target, click on Add Row. To Edit an existing row/target, select the row and click Edit. The values are edited via the controls at the top of the window, then Save the row/target. Press Save All and close the window to return to the Config Modules window.

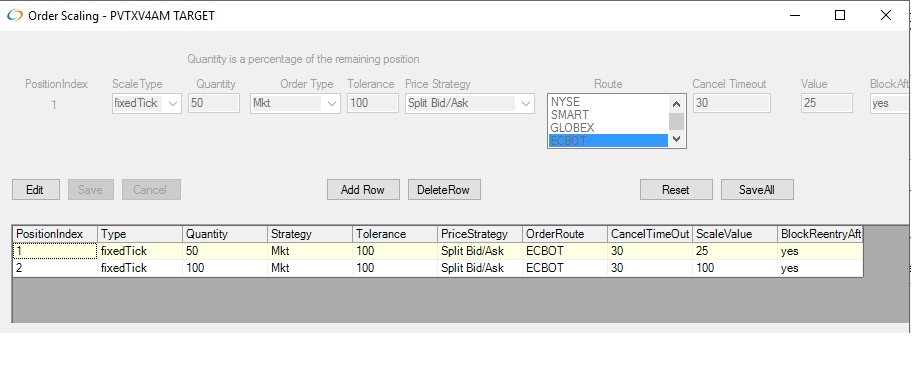

The orders are sent in the order of the value of PositionIndex, when the exit criteria is met. For example in the above image, the type is “fixedTick” with scale values of 25, 100. The Quantity is a percentage of the total position size or 50% of the position size. For futures, you must make the position quantity a multiple of the rows configured in ScaleOut. For this example, the quantity( in the Entry parameters tab) is 2 contracts. Scaleout order 1 (Position Index 1) will be sent when the price reaches the Entry Price + 25 ticks. The Quanity sent will be 50% of the position, or 1 contract. The second order would be sent when the price of Entry Price + 100 ticks is reached and 100% of the remaining position(1 contract) will be sent, as configured by row 2.

The values configured in the row correspond to the values in the Target Exit tab.

The Target(or Stop) column of KATP will display the current Position Index and target price of the current target. Prior to the First Target being hit (Assuming an entry price of 25 and 0.25 ticks/point), it will show 1:31.25. Once the first target is hit, it will show 2:50 for the second target.

Since a scaled limit order is not guaranteed to be filled completely, a market or a lmt persist order, which will ensures a fill, should be used.

For targets the ScaleType can be

- Fixed

- fixedTick

- percentage

- FixedDollar

The ScaleValue should be set according to the type of ScaleType selected. Refer to the Kairos documentation for details on the Stop and Target Types.

Configuring Target Scaleouts works together with stop orders that end in ‘Adjst’. As Targets are hit , the ‘Adjst’ stop orders are tightened or adjusted by the percentage that the position has been reduced. For example if there are 2 contracts, and the first target reduces the position by 50% by selling 1 contract, then the stop value is also reduced by 50%. The Stops named ‘FixedXToSldY’ are also converted from a Fixed Stop for the initial(first) target, to a sliding stop with a tightened or adjusted stop. For more details on the types of stops, see the Stop Exit Parameters section.

- FixedAdjst

- FixedToSldAdjst

- FixedPctAdjst

- FixedPctToSldAdjst

- SlidingAdjst

- SlidingPctAdjst

- FixedTickAdjst

- FixedTickToSldAdjst

- SlidingTickAdjst

- FixedDollarAdjst

- FixedDollarToSldDlrAdjst

- SlidingDollarAdjst